What’s Next for the 2025 Housing Market? Here’s What Experts Predict—And How It Impacts 30A

A Quick Mid-Year Snapshot

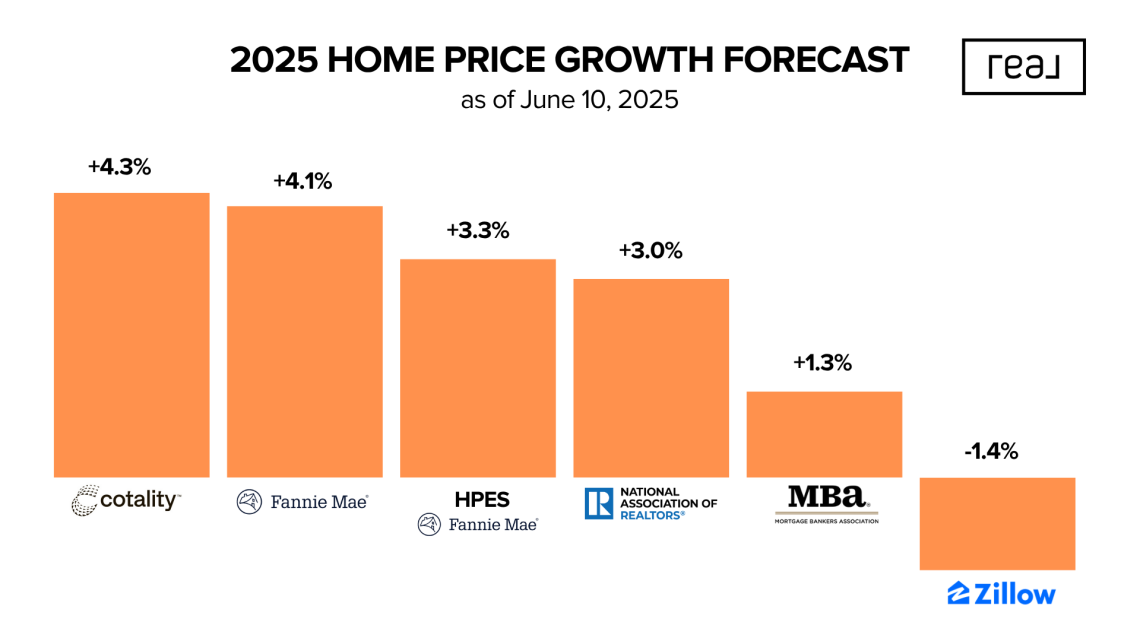

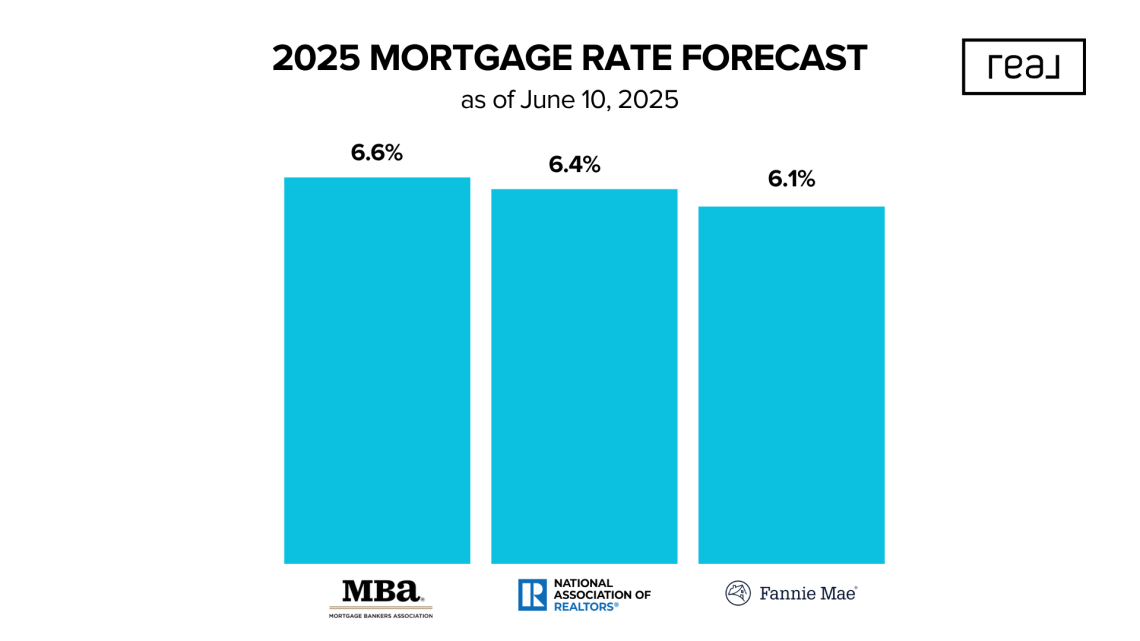

Can you believe we’re already halfway through 2025? National analysts—from Fannie Mae to the National Association of REALTORS® (NAR)—have updated their projections for home prices, mortgage rates, and sales activity for the remainder of the year. Most agree on three themes:

Modest price growth nationwide but wide local variation.

Gradual recovery in existing-home sales as inventory improves.

Mortgage rates likely to remain above 6% but inch lower into 2026.

Before we dive into the local 30A picture, let’s review the big-picture data on a national real estate scale.

Local Price Trends: How 30A Communities Differ

Here on Scenic 30A, the market refuses to move in lock-step with national averages—or even with itself:

Overall sold prices are down ~11% year-over-year.

Prominence is shouldering the biggest cuts, with deeper discounts on both A- and B-Units.

Rosemary Beach and Alys Beach are examples of communities that have held steady to slightly positive—proof that premium walk-to-beach luxury still appeals to today's buyers.

Mid-range family-favorites like Seagrove Beach have softened but remain attractive to value-hunters eyeing rental potential.

Bottom line: You can’t slap a single “30A real estate trend” label on every community. Understanding micro-markets street by street (and HOA fee by HOA fee) is where true opportunity lies.

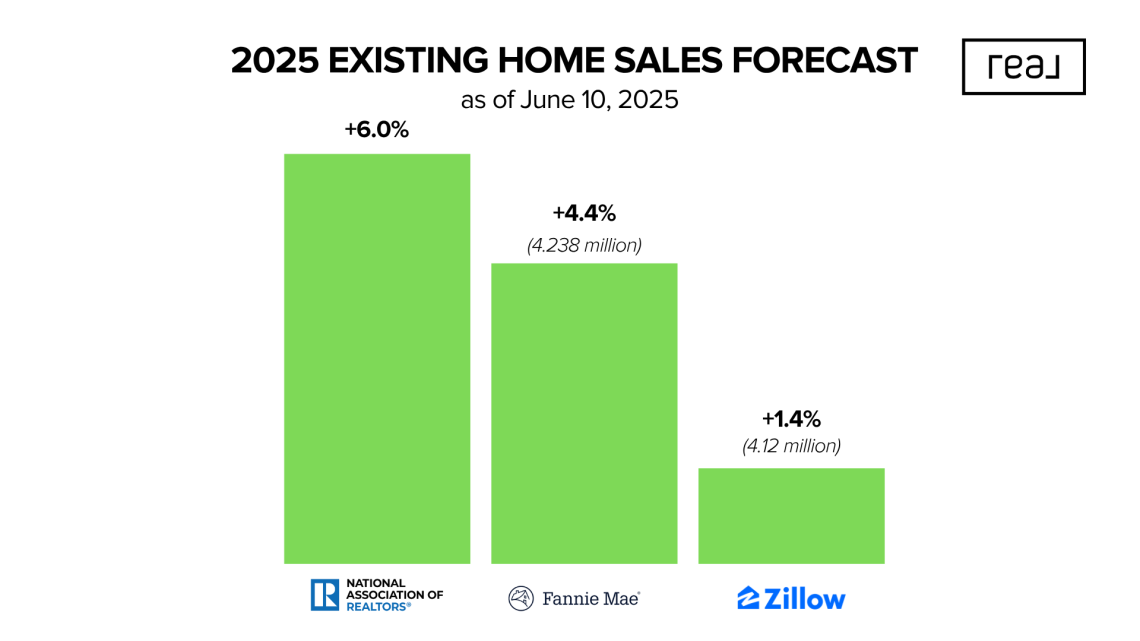

Existing-Home Sales Outlook

Nationally, economists see a slow-burn rebound as inventory loosens and mortgage rates drift lower.

On 30A: Inventory has already surged 14% year-over-year, giving buyers more choices than at any time since early 2020. Yet total closings remain muted because rate-sensitive buyers are waiting for more significant relief.

Inventory, Days on Market & Buyer Activity on 30A

Listings up: +14% YOY

Average Days on Market: +5.7% YOY—homes are taking longer to sell.

Buyer Activity: Low, especially among financed purchasers. Cash buyers and 1031-exchange investors constitute a greater share of showings.

Personal insight from the field: When a truly turn-key property in a high-amenity neighborhood (think WaterColor’s Camp District or Watersound Beach’s Gulf-front homes) hits the market and is priced right, it still sells quickly. Everything else sits—and serious buyers are negotiating price cuts and hefty seller credits rarely seen in recent memory.

Mortgage-Rate Predictions Through 2026

NAR Chief Economist Lawrence Yun calls rates the “magic bullet” for unlocking pent-up demand. If we see even a half-point drop by spring 2026, expect sidelined first-time and move-up buyers to re-enter quickly.

How 30A Buyers Are Reacting

Many are testing offers substantially under the current list prices.

Others shift to ARM options or buy-down credits from sellers to bridge the gap.

Cash is king: roughly one in three 30A closings this spring were cash, eliminating rate anxiety altogether.

What Today’s Market Means for 30A Buyers

Opportunity is peaking right now. With inventory high and DOM climbing, serious buyers hold rare leverage:

Choice: From Gulf-front cottages in Grayton Beach to new-build townhomes in Prominence, selection is as wide as we’ve seen in years.

Negotiation Power: Double-digit price cuts, closing-cost credits, or furniture packages are on the table.

Potential Upside: Even if prices slip another few points, the long-term rental and appreciation outlook for walkable beach communities remains strong.

Pro Tip: Pair an interest-rate buy-down with today’s discounted list price. When rates drop, you can refinance—capturing both the price savings and the future rate reduction.

Game-Plan for 30A Sellers

Selling in a slow-moving market is not about waiting for 2026—buyers are still transacting, just more selectively. Homes that fly off the shelf right now share three traits:

Turn-key condition (fresh paint, updated furnishings, no deferred maintenance).

Compelling lifestyle factor—strong amenity package, golf-cart distance to the beach, or rental projections > $100K/yr.

Aggressive, data-driven pricing (sitting 2–4% below last quarter’s comps).

Need a deeper dive on what makes a listing “irresistible” in 2025? See my breakdown of the 5 Smart Moves Sellers are Making in Today's Market in last week's article.

Key Takeaways & Next Steps

National outlook: Expect moderate price growth (+1–4%) and slow sales recovery into 2026.

30A reality: Overall prices down 11% YOY, but luxury enclaves like Rosemary Beach hold firm. Inventory +14% means buyers have leverage; DOM up 5.7%.

Rates: Likely to stay in the mid-6% range through late 2025, edging toward high-5% territory in 2026.

Action items for buyers:

Get pre-approved (or proof of funds ready) so you can pounce on discounted gems.

Negotiate rate buy-downs or seller credits before competition heats up.

Action items for sellers:

Price with precision, prep the property to shine, and lean on hyper-local marketing to stand out.

Consider offering buyer incentives—closing credits, buy-downs, or including a golf cart/furnishings—to widen your pool.

Let’s Talk About Your Next Move

Every 30A community—from Blue Mountain to WaterSound—has its own micro-market story in 2025. If you’re curious how these trends impact your beach-home goals, let’s connect for a no-pressure strategy call.

Book a Call on My Calendar Here!

Call/Text: 850-585-0642 • Email: [email protected]

Together, we’ll craft a plan that turns today’s market realities into tomorrow’s success—whether that’s locking in a dream vacation home or positioning your property to sell for top dollar.

Questions About the 30A Market?

Get in touch. We're here to offer guidance and expertise leading you to achieving your goals on 30A!