Q2 2025 30A Real Estate Market Report: What Buyers and Sellers Need to Know

As the sun sets on the first half of 2025, the 30A real estate market is showing clear signs of transition. After years of unprecedented growth and a flurry of activity during the pandemic-fueled boom, we are now seeing a more balanced, even patient, market along Florida's most sought-after stretch of coastline. Whether you're considering purchasing a second home, investing in a vacation rental, or selling your beach property, the Q2 2025 data holds valuable insights to guide your next move.

Let's break down what the numbers reveal and what it means for you.

Key Takeaways from Q2 2025

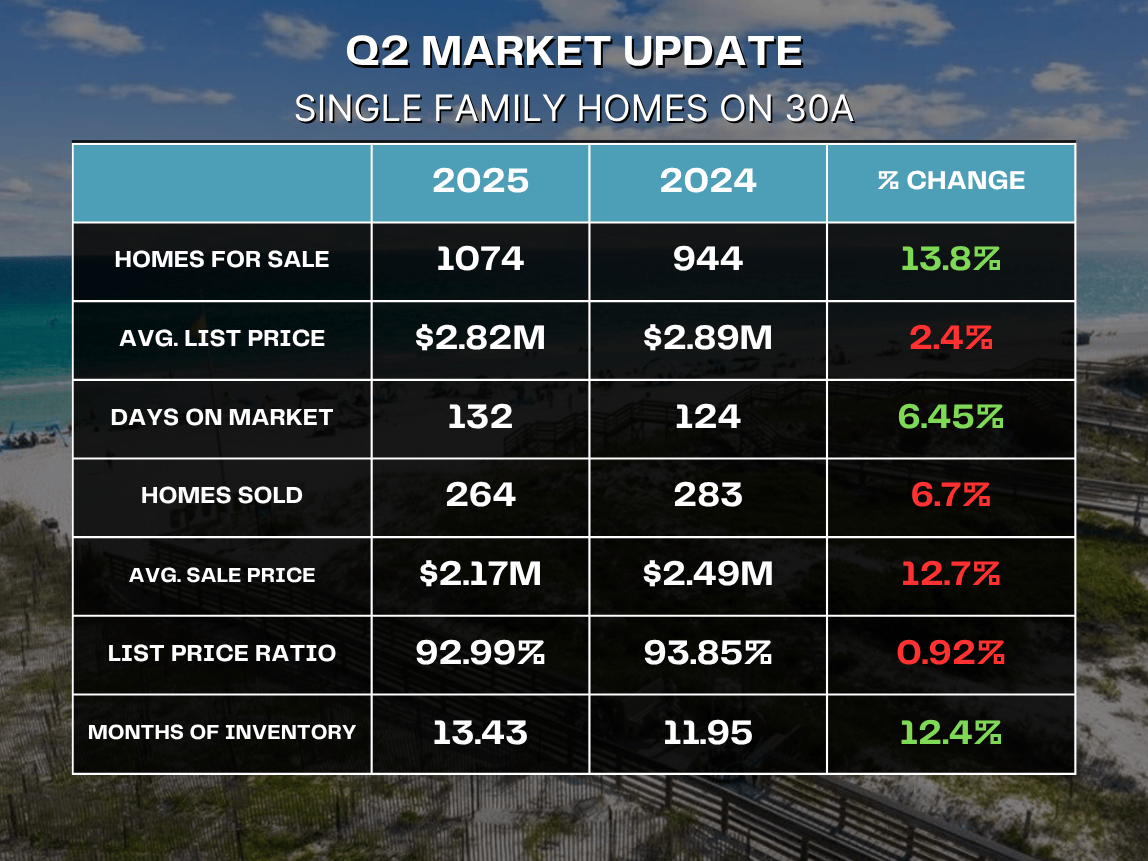

- Homes Sold: 264 (down 6.7% from Q2 2024)

- Average Sold Price: $2,172,406 (down 12.7% YoY)

- List-to-Sale Price Ratio: 92.99% (slightly down from 93.85%)

- Total Homes for Sale: 1,074 (up 13.7% YoY)

- Average Days on Market: 132 days (up 6.5% YoY)

- Average List Price: $2.82M (slightly down from $2.89M)

- Months of Inventory: 13.43 (up from 11.95)

These figures paint a picture of a market that is recalibrating. After several years of soaring prices and ultra-competitive bidding wars, the market is finding a new equilibrium—which could offer opportunity for both buyers and sellers.

.png?w=1140)

What This Means for Buyers

If you’ve been waiting for the frenzy to subside before making your move on 30A, your patience may be paying off. With total inventory up nearly 14% year-over-year and average prices down over 12%, buyers now have more leverage and choice than they’ve seen in years.

But it’s important to note that not all homes are experiencing the same level of price adjustment. Turnkey properties—those that are newer, fully furnished, and positioned as strong short-term rentals—are still attracting significant attention. For buyers seeking a vacation rental or second home, these are often worth acting on decisively.

Additionally, with an average days on market of 132 days, there’s less pressure to make split-second decisions, but the best opportunities can still move quickly.

Key Buyer Insight: This is a season of negotiation and opportunity, but having a local expert who understands which properties are seeing price flexibility is crucial.

What This Means for Sellers

For homeowners considering selling their 30A property, the story is different but equally important. With months of inventory rising to over 13 months and the list-to-sale price ratio slipping slightly, pricing and presentation are more critical than ever.

Gone are the days when sellers could set aspirational prices and expect multiple offers in days. Today’s buyers are more discerning, and homes that fail to align with current market expectations risk lingering unsold.

However, this doesn’t mean sellers are without opportunity. Well-prepared homes, particularly those with desirable locations south of 30A or unique features, are still moving. Investing in staging, professional photography, and a robust marketing strategy—including video walkthroughs and off-market exposure—can make a significant difference.

Key Seller Insight: Strategic pricing and exceptional marketing are the keys to standing out in a more crowded market.

Why Are Average Prices Down?

It’s tempting to view the 12.7% dip in average sold price as a sign of broad value loss, but context is key. The decline is largely due to a shift in the composition of sold homes. Last year saw more ultra-luxury sales topping $5M, which elevated the averages. This year, more activity has occurred in the $1M–$3M range, pulling averages down.

Another factor: some buyers are adjusting expectations in light of sustained higher interest rates. Instead of stretching budgets, they’re targeting value-rich properties in emerging or mid-tier neighborhoods.

This nuance underscores why sellers must understand their specific market segment rather than relying solely on broad averages.

Looking Ahead: Q3 2025 and Beyond

Summer is traditionally one of 30A’s busiest seasons, with visitors falling in love with the beach lifestyle and envisioning their own slice of paradise. As we head into Q3, several factors will shape the market:

Interest Rates: Even a modest dip could reignite buyer demand.

Inventory Levels: Continued growth in inventory could offer buyers more negotiating power.

Seasonal Timing: Fall buyers often seek to secure homes before the holiday season, making Q3 an important window for sellers.

For buyers, this is a chance to shop more deliberately and lock in favorable terms before competition potentially heats up in Q4. For sellers, now is the time to prepare—decluttering, addressing repairs, and partnering with an agent who can elevate your listing above the competition.

Final Thoughts

The 30A real estate market in mid-2025 is balanced, nuanced, and full of opportunity for those who are prepared. Buyers benefit from choice and negotiating room, while sellers succeed by pricing strategically and delivering standout presentation.

Navigating this kind of market requires experience, insight, and a pulse on hyper-local trends. As your local 30A expert, I’m here to guide you through these shifts with a customized plan that meets your goals.

Ready to Take the Next Step?

Get in touch. I'm here to offer guidance and expertise leading you to achieving your goals on 30A!