30A Real Estate: A Proven Path to Long-Term Wealth

A Tangible Asset in a Volatile World

Have you ever scrolled through your brokerage app, watched stock prices swoop up and down, and thought, “There’s got to be a more predictable way to build wealth”? You’re not alone. Even Warren Buffett—arguably the greatest stock investor ever—acknowledges that stocks offer unmatched liquidity and ease of diversification. But what he doesn’t always emphasize is that companies can and do fail overnight. One shocking bankruptcy here, a sector-wide meltdown there, and suddenly years of paper gains vanish in a flash.

That’s precisely why so many high-net-worth individuals are turning to a different kind of asset: physical real estate, and more specifically, 30A real estate. For buyers seeking a second home, a luxury vacation residence, or an income-producing investment, the shimmering coastline of Scenic Highway 30A provides a rare combination of lifestyle enjoyment and long-term wealth appreciation.

The National Real Estate Story: Steady as She Goes

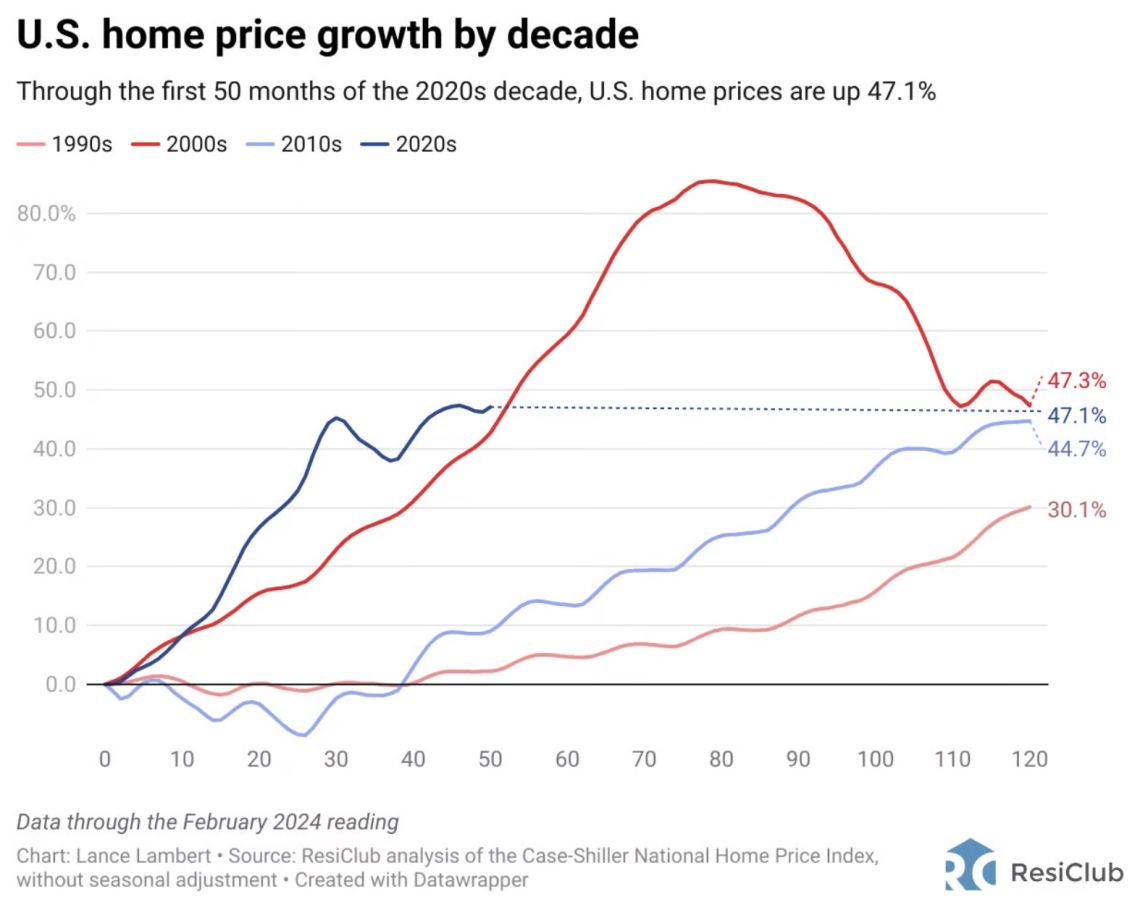

Before we zero in on the microcosm of 30A, let’s zoom out to the national level. Below is a chart from ResiClub, tracking U.S. home-price growth by decade, based on the Case–Shiller National Home Price Index through February 2024:

Here’s what you need to know about these numbers:

1990s (▲30.1%): Even as interest rates and economic cycles ebbed and flowed, homeowners saw their equity grow by nearly a third over ten years.

2000s (▲47.3%): This period included the 2008 crash—yet, from start to finish, home prices still climbed almost 50%.

2010s (▲44.7%): Post-crisis recovery and historically low mortgage rates fueled another strong decade of appreciation.

First 50 months of the 2020s (▲47.1%): Through early 2024, home values are up nearly half again—despite pandemic shutdowns and shifting work habits.

The takeaway? Over multiple economic cycles, real estate has demonstrated remarkable resilience and compounding returns. Unlike stocks—where forced selling or margin calls can wipe out gains—real estate ownership forces you to hold through short-term dips, recover from downturns, and benefit from the powerful tide of inflation-plus-growth over decades.

Why 30A Real Estate Outperforms the National Trend

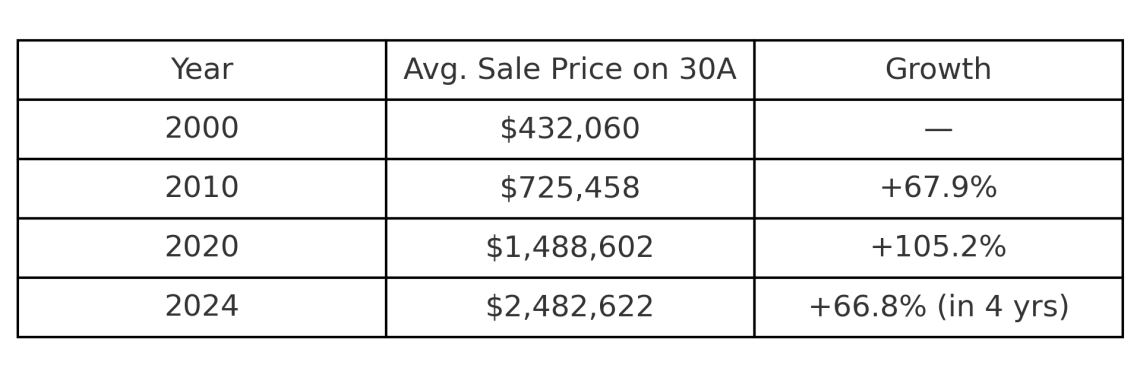

If the national real estate market is a high-performing mutual fund, 30A luxury vacation homes are the blue-chip stocks of coastal investing—and they’ve delivered outsized returns:

Over the past 24 years, 30A real estate has more than quadrupled in value—easily eclipsing national averages. That translates to an approximate annualized appreciation north of 6% before you even factor in rental income or mortgage pay-down. And when you consider that those returns come alongside one of the most desirable vacation destinations in the country, the case for investing in 30A vacation homes becomes hard to ignore.

The Rental-Income Reality Check

It wasn’t so long ago that buying a 30A vacation home meant enjoying robust nightly rates that covered mortgage payments, HOA dues, insurance, and left a tidy positive cashflow. But today, a few market dynamics have shifted:

Supply Influx: Lower barriers to entry and an explosion of short-term rental platforms have increased competition.

Rising Financing Costs: Mortgage rates have climbed from sub-3% territory to the 7% range, significantly raising monthly debt service.

Escalating Carrying Expenses: HOA fees in luxury coastal communities continue to rise, and insurance premiums for beachfront and gulf-front properties have risen as well.

Outcome: Pure rental revenue rarely completely covers ownership costs anymore—though in peak summer months, you may still break even or see a modest profit. More often, rental income now offsets a large portion of your carrying expenses, reducing your net cost of ownership.

Key point: Don’t judge a 30A investment solely on short-term cashflow. While income does provide valuable support, the true wealth creation engine is long-term appreciation—backed by 20+ years of data showing compounded growth that crushes many other asset classes.

Leverage: Your Multiplier for Growth

One of real estate’s greatest advantages is leverage. With just a 20% down payment, you gain 100% exposure to home-price appreciation. Let’s illustrate:

Suppose you purchase a $1 million 30A second home with $200,000 down and an $800,000 mortgage.

If home values rise by 66.8% over four years (mirroring the 2020–2024 trend), your property’s value climbs to $1,668,000.

You’ve turned a $200,000 equity stake into $868,000 of equity—a 434% gain on your down payment—before including principal pay-down or rental income.

Contrast that with a 66.8% gain in an un-leveraged stock portfolio: you’d need to invest the entire amount up front to capture the same dollar appreciation.

Tax Efficiency: The Hidden Boost

Another pillar of the 30A real estate proposition is tax efficiency:

Mortgage-Interest Deduction: For both primary residences and certain second homes, interest can be deductible—reducing your taxable income.

Depreciation (for investors): You can write off a portion of your property’s value each year against rental income, even if the home is appreciating in market value.

Favorable Capital Gains Treatment: Sell after holding longer than one year, and you qualify for long-term capital gains rates—typically well below ordinary income brackets.

1031 Exchange: Want to trade a fully depreciated property for a new 30A luxury home? A properly structured exchange defers capital gains taxes, letting more of your equity stay invested and compounding.

These advantages stack to boost your net returns well above the headline appreciation figures.

The Enduring Lifestyle Appeal

When you buy a vacation home on 30A, you’re not just buying square footage—you’re buying an experience that high-end travelers crave year after year:

Pristine Beaches & Scenic Trails

Beach pavilions at Seaside, WaterColor, and Grayton Beach

20+ miles of bike-friendly trails along Scenic Highway 30A

Curated Town Centers

Seaside’s pastel-hued boutiques and the “New Town, Old Ways” ethos

Rosemary Beach’s European-inspired piazzas and fitness lawn

Culinary & Cultural Highlights

Fresh Gulf seafood at Great Southern Café and Modica Market

Sundog Books and Seaside Style for artful gifts and local history

This lifestyle magnetism creates a virtuous cycle: affluent visitors return, demand remains high, and appreciation accelerates. It also provides the peace of mind that even if you decide to move or sell, there will always be eager buyers lined up.

Busting the “Timing the Market” Myth

A common refrain I hear from ready-to-invest clients is, “I’m waiting for prices to dip.” Here’s why that rarely pays off on Scenic Highway 30A:

Consistent Upside: Since 2000, average area home prices have climbed from $432,060 to $2,482,622—a 475% gain over 24 years. Even taking short-term volatility into account, the longer-term trend is emphatically upward.

Opportunity Cost: Every month you delay is equity you’re not building, against a backdrop of inflation that erodes purchasing power.

Forced Savings: Unlike rent payments that disappear into your landlord’s pocket, each mortgage payment on your 30A second home accelerates your ownership stake—helping you retire debt over time.

Rather than chasing market timing, the wisest strategy is to identify a property that fits your goals—whether it’s a chic condo steps from the beach in Rosemary or a sprawling cottage in Seagrove—and lock in your position

Crafting a Balanced Portfolio with 30A Real Estate

The real power of 30A real estate emerges when you integrate it into a diversified investment strategy:

Equity Exposure: Coastal homes offer equity growth that can outpace stock market returns, especially when leveraged.

Income Generation: While rental income may not fully cover costs today, it cushions your cashflow and reduces net carrying expenses.

Inflation Hedge: Real estate historically tracks or outpaces inflation, preserving your purchasing power.

Lifestyle Utility: Enjoy your second home during peak seasons, while the rest of the year it works for you as part of an investment portfolio.

By allocating a portion of your investable assets to luxury vacation homes on 30A Florida, you mitigate volatility, tap into tangible-asset strength, and secure a lifestyle advantage that few other investments can match.

Your Next Steps: Partnering with a 30A Specialist

If you’re ready to explore 30A real estate as part of your wealth-building strategy, here’s how we can work together:

Discovery Call: Let’s discuss your goals—whether that’s weekend getaways, rental revenue, or long-term appreciation.

Market Deep Dive: I’ll provide a customized analysis of neighborhoods like Seaside, WaterSound, and Grayton, including historical appreciation, rental trends, and projected cashflow scenarios.

Property Matching: Based on your investment criteria (budget, desired return, lifestyle fit), I’ll curate a selection of on- and off-market 30A homes for sale.

Financing & Tax Strategy: We’ll coordinate with your financial advisor to structure the optimal loan, leverage 1031 exchanges as needed, and maximize deductions.

Closing & Beyond: From contract to keys, I’ll ensure a smooth transaction. Post-close, I’ll connect you with local property managers to optimize rentals and protect your asset.

Final Thoughts: The Coastal Compounding Effect

Real estate isn’t a get-rich-quick scheme—it’s a get-rich-slowly, enjoy-the-journey strategy. Along Scenic Highway 30A, that journey comes with world-class beaches, bikeable towns, and a welcoming community of second-home owners who value both lifestyle and long-term wealth.

While stocks will always have their place in your portfolio, remember that companies can vanish overnight—but homes—and the memories you make in them—endure. If you’re seeking a luxury vacation home on 30A Florida or looking to invest in 30A second home opportunities, let’s start the conversation. Schedule a call by clicking here or the button below!

Let's work together to secure your slice of paradise—and ride the wave of coastal appreciation for decades to come.

Ready to Add a 30A Home to Your Investment Portfolio?

Schedule a Call Today.

We're here to offer guidance and expertise leading you to achieving your goals on 30A!